Latest News

A decade ago, this company emerged from an industrywide crisis far stronger. Now history may be repeating.

Via The Motley Fool · December 30, 2025

Does this company exemplify everything wrong with the AI boom?

Via The Motley Fool · December 30, 2025

Ethereum is poised to take off in the years to come.

Via The Motley Fool · December 30, 2025

Neither had a great year in 2025, but the future is looking bright.

Via The Motley Fool · December 30, 2025

Most people never see the biggest-possible payment, but everyone can do at least a little more to maximize their particular benefit.

Via The Motley Fool · December 30, 2025

Check out the companies making headlines yesterday:

Via StockStory · December 30, 2025

Why pay more for banking than absolutely necessary? Here's how to find a bank or credit union that won't take money from your account.

Via The Motley Fool · December 30, 2025

Cypherpunk acquired privacy-oriented cryptocurrency for about $29 million.

Via Stocktwits · December 30, 2025

The Chinese government announced a first tranche of 62.5 billion yuan ($8.92 billion) in subsidies to support the trade-in of consumer goods in the country, according to a statement.

Via Stocktwits · December 30, 2025

The streaming giant could be entering a transformative era with its acquisition of Warner Bros.

Via The Motley Fool · December 30, 2025

CECO Environmental Corp. fits the CANSLIM growth strategy with strong earnings momentum, high relative strength, and institutional support in a positive market trend.

Via Chartmill · December 30, 2025

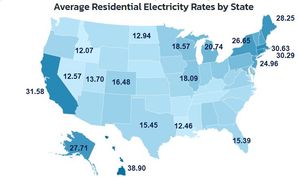

Hawaii and California have the highest rates. Idaho is the lowest.

Via Talk Markets · December 30, 2025

The company’s board approved a 1-for-35 reverse stock split to maintain compliance with Nasdaq’s $1.00 minimum bid requirement.

Via Stocktwits · December 30, 2025

Via MarketBeat · December 30, 2025

Hyperscale shares jump premarket as its bitcoin treasury exceeds its market cap at 117.8%

Via Stocktwits · December 30, 2025

Investors had no shortage of excitement in 2025, and another epic year in the stock market looks to be on tap for 2026.

Via The Motley Fool · December 30, 2025

HealthEquity (HQY) exemplifies GARP investing with solid earnings growth, a reasonable valuation, and strong financial health.

Via Chartmill · December 30, 2025

Wondering what's happening in Tuesday's pre-market session? Find an overview in this article.

Via Chartmill · December 30, 2025

Vertiv (VRT) exemplifies the CAN SLIM investing method with strong earnings growth, high relative strength, and solid institutional support.

Via Chartmill · December 30, 2025

FX markets remain subdued as we sit in the quiet window between Christmas and New Year, with limited follow-through across major pairs.

Via Talk Markets · December 30, 2025

Brighthouse Financial is being taken private by a private equity firm.

Via The Motley Fool · December 30, 2025

Albertsons Companies (NYSE: ACI) will report Q3 earnings on Jan. 7. Analysts forecast 68 cents/share and $19.17B revenue. Dividend yield is 3.47%.

Via Benzinga · December 30, 2025

SlowMist reported 48 instances of hijacked X accounts, indicating a shift toward phishing and social engineering over smart-contract exploits.

Via Stocktwits · December 30, 2025