Recent Articles from PredictStreet

The race for artificial intelligence supremacy is entering its most volatile phase of the decade. As of February 9, 2026, all eyes are on Anthropic, the San Francisco-based AI safety and research lab, as traders on Polymarket and other prediction platforms scramble to price in the arrival of Claude 5. Currently, a highly active market [...]

Via PredictStreet · February 9, 2026

The quest for Artificial General Intelligence (AGI) has shifted from the realm of science fiction to a high-stakes financial game. As of early February 2026, the most scrutinized metric in the tech world isn't a quarterly earnings report or a hardware benchmark; it is a probability percentage on a prediction market. Currently, traders on the [...]

Via PredictStreet · February 9, 2026

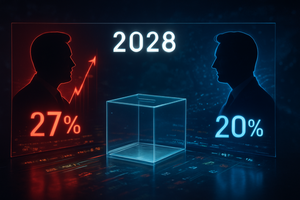

As the United States settles into the second year of the second Trump administration, the political world is already looking toward the horizon. While the 2026 midterms are the immediate hurdle, prediction markets are buzzing with high-stakes activity surrounding the 2028 Presidential Election. The early favorites have emerged with startling clarity: Vice President JD Vance [...]

Via PredictStreet · February 9, 2026

As of February 9, 2026, the political future of Keir Starmer has reached what traders are calling a "terminal trajectory." On the decentralized prediction platform Polymarket, the probability that Starmer will be out of office by June 30, 2026, has surged to a staggering 68%. This represents a dramatic shift from just six months ago, [...]

Via PredictStreet · February 9, 2026

As of February 9, 2026, the cryptocurrency market is caught in a high-stakes tug-of-war between a brutal technical correction and a resurgence of institutional "buy-the-dip" conviction. Following a dizzying peak near $126,000 in late 2025, Bitcoin (BTC) endured a flash crash to $60,062 just days ago on February 6. Now, as the price stabilizes between [...]

Via PredictStreet · February 9, 2026

As the lights dim at Levi’s Stadium for Super Bowl LX, the action on the field is being mirrored by an unprecedented financial frenzy in the digital arena. The "Legacy Rematch" between the Seattle Seahawks and the New England Patriots has officially become the most traded sporting event in the history of prediction markets, with [...]

Via PredictStreet · February 9, 2026

As of February 9, 2026, the race for artificial intelligence supremacy has reached a fever pitch, but prediction market bettors believe the winner is already clear. Anthropic, the San Francisco-based AI safety and research company, has surged to a commanding 68% probability of holding the title of "Best AI Model" by the end of the [...]

Via PredictStreet · February 9, 2026

As the torch burns bright over Milano-Cortina for the 2026 Winter Olympics, the battle for international supremacy is already reaching a fever pitch—not just on the slopes, but in the high-stakes world of prediction markets. Just three days into the official competition, Norway has emerged as a staggering favorite to top the gold medal leaderboard, [...]

Via PredictStreet · February 9, 2026

As the diplomatic thaw of the winter freezes over, the shadow of conflict in the Middle East has lengthened. On the decentralized prediction platform Polymarket, the collective intelligence of thousands of global traders is currently pricing in a staggering 56% probability that the United States will conduct a kinetic strike against Iran by June 30, [...]

Via PredictStreet · February 9, 2026

As the countdown to the end of Jerome Powell’s tenure at the Federal Reserve begins, prediction markets have reached a state of near-unanimity. Kevin Warsh, the former Fed Governor and long-time favorite of the Republican establishment, has emerged as the overwhelming frontrunner to be the next Chair of the Federal Reserve. According to data from [...]

Via PredictStreet · February 9, 2026

In the high-stakes world of global diplomacy and macroeconomics, traditional intelligence and polling have often struggled to keep pace with the rapid-fire shifts of the 2020s. However, as of February 8, 2026, a new class of "truth engines" has emerged as the definitive guide for investors navigating a fractured world. Prediction markets, once seen as [...]

Via PredictStreet · February 8, 2026

As of February 8, 2026, the artificial intelligence sector is moving at a pace that traditional tech journalism can barely track. On Manifold Markets, a leading prediction platform known for its real-time crowdsourced intelligence, a feverish surge of betting activity has centered on the "Agentic Spring." The most watched contract on the site currently gives [...]

Via PredictStreet · February 8, 2026

As of February 8, 2026, Bitcoin is locked in a fierce battle around the $70,000 mark, a level that has become the definitive "line in the sand" for traders on decentralized prediction platforms. On Polymarket, the world’s leading prediction market, the probability of Bitcoin touching $70,000 this month has surged to a commanding 71%, up [...]

Via PredictStreet · February 8, 2026

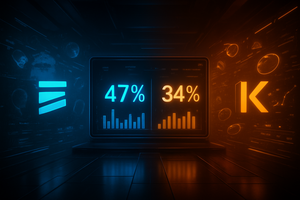

As the prediction market industry enters its most volatile and high-stakes year to date, the internal rivalry between the sector’s two largest titans has spilled over into the markets themselves. On Manifold Markets, a high-liquidity "meta-market" titled "Top 1 prediction market by volume in 2026?" has become the primary scoreboard for what insiders are calling [...]

Via PredictStreet · February 8, 2026

The high-stakes world of prediction markets is currently facing its most existential threat since the landmark 2024 election cycle. As of February 8, 2026, Kalshi—the first federally regulated prediction market—is locked in what legal scholars are calling a "guerrilla war" with state gaming regulators in Massachusetts, Nevada, and Connecticut. At the heart of the conflict [...]

Via PredictStreet · February 8, 2026

The prediction market landscape shifted significantly this week as the world’s leading forecasting platform, Polymarket, officially commenced its transition to native USDC for on-chain settlement. In a strategic partnership with Circle Internet Group (NYSE: CRCL), the move marks the definitive end of the "bridged asset" era for the platform, replacing the older, more vulnerable USDC.e [...]

Via PredictStreet · February 8, 2026

As of February 8, 2026, the intersection of decentralized finance and urban politics has reached a fever pitch in New York City. Prediction market giant Polymarket has announced a "free grocery store" pop-up in downtown Manhattan, a move that traders are betting will either be a masterstroke of PR or a regulatory lighting rod. Currently, [...]

Via PredictStreet · February 8, 2026

The intersection of professional sports and prediction markets reached a fever pitch this week as Milwaukee Bucks superstar Giannis Antetokounmpo officially joined Kalshi as a major shareholder. The announcement, made on February 6, 2026, through his family office and investment arm, Ante Inc., has sent shockwaves through both the financial and athletic worlds. With the [...]

Via PredictStreet · February 8, 2026

As the Seattle Seahawks and New England Patriots prepare to take the field for Super Bowl LX at Levi’s Stadium, the real action is happening on digital ledger boards and order books. In a historic first for the industry, the 2026 Super Bowl has become the most heavily traded sporting event in the history of [...]

Via PredictStreet · February 8, 2026

The tech world is still reeling from the announcement made on February 5, 2026, during Amazon.com Inc. (NASDAQ: AMZN) Q4 2025 earnings call. CEO Andy Jassy stunned investors and analysts alike by unveiling a staggering $200 billion capital expenditure (capex) target for the 2026 fiscal year—a nearly 60% jump from the previous year. While traditional [...]

Via PredictStreet · February 7, 2026

While the dust of the 2024 election has long since settled, the gaze of the political and financial worlds has already shifted toward the next horizon. As of February 7, 2026, prediction markets for the 2028 Democratic Nominee have reached an unprecedented level of early activity. On Kalshi, the premier regulated event contract exchange, the [...]

Via PredictStreet · February 7, 2026

As the second Trump administration enters its second year, the "honeymoon phase" for his Cabinet appears to be over—at least according to prediction markets. On the regulated exchange Kalshi, traders are increasingly betting on a major shakeup in the President's inner circle. Recent weeks have seen a sharp spike in the probability of departures for [...]

Via PredictStreet · February 7, 2026

As of February 7, 2026, the era of aggressive interest rate cuts appears to have hit a significant roadblock. For months, investors had been pricing in a steady glide path toward lower rates, but a recent string of robust economic data and hawkish rhetoric from Federal Reserve officials has fundamentally reshaped the narrative. On the [...]

Via PredictStreet · February 7, 2026

As the ceremonial fires of the XXV Olympic Winter Games flicker in the dual host cities of Milan and Cortina d'Ampezzo, the world’s attention has shifted from the spectacle of the opening ceremony to the high-stakes reality of the podium. On the world’s leading prediction platform, Polymarket, a clear consensus has emerged: Norway is the [...]

Via PredictStreet · February 7, 2026

With just twenty-four hours remaining until kickoff at Levi’s Stadium, the spotlight isn't just on the Seattle Seahawks and the New England Patriots. In the prediction markets, a different kind of high-stakes drama is unfolding. Traders have poured more than $7 million into Kalshi alone, speculating on every detail of the Apple Music (NASDAQ: AAPL) [...]

Via PredictStreet · February 7, 2026

As of February 7, 2026, the intersection of aerospace engineering, artificial intelligence, and retail speculation has found a permanent home in prediction markets. With the recent, earth-shaking announcement of a merger between SpaceX and xAI on February 2, traders are no longer just betting on individual rocket launches; they are wagering on the formation of [...]

Via PredictStreet · February 7, 2026

As of February 7, 2026, the geopolitical world is fixated on a high-stakes question that has long been whispered in the corridors of power in Tehran: when will the era of Ayatollah Ali Khamenei end? For years, this was the subject of classified intelligence briefs and academic speculation. Today, it is a $17 million market [...]

Via PredictStreet · February 7, 2026

As of February 7, 2026, the intersection of high-stakes diplomacy and military posturing has turned the eyes of the world toward the Persian Gulf. Prediction markets are currently pricing in a significant probability of military conflict between the United States and Iran, with the flagship "U.S. strike on Iran" market on Polymarket seeing its cumulative [...]

Via PredictStreet · February 7, 2026

The race to lead the world’s most powerful financial institution has moved from the boardrooms of Washington to the high-stakes arena of prediction markets. As of February 7, 2026, Kevin Warsh has emerged as the overwhelming favorite to succeed Jerome Powell as Chair of the Federal Reserve, commanding a staggering 94% probability on the prediction [...]

Via PredictStreet · February 7, 2026

In the world of retail finance, the "meme stock" era has officially been replaced by the "event contract" era. Leading this charge is Robinhood (NASDAQ: HOOD), which has successfully pivoted its massive user base from speculative equity trading toward the rapidly expanding frontier of prediction markets. As of early February 2026, the platform has moved [...]

Via PredictStreet · February 6, 2026

The landscape of global finance shifted permanently this winter as the Intercontinental Exchange (NYSE: ICE) finalized a staggering $2 billion strategic investment into Polymarket. For years, prediction markets were viewed as the "Wild West" of decentralized finance—a niche playground for crypto-natives and political junkies. However, with the backing of the world’s most powerful exchange operator, [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the traditional landscape of geopolitical analysis is undergoing a radical transformation. While cable news pundits and academic experts grapple with the nuances of diplomatic cables and legislative posturing, a more precise—and often more brutal—barometer has emerged: the prediction market. In the first week of February, these markets have become the [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the digital landscape has undergone a tectonic shift. Once relegated to the fringes of the internet and dismissed as "speculative casinos," prediction markets have officially entered the mainstream. This transformation is crystallized by the recent, sweeping policy updates from Alphabet (NASDAQ: GOOGL) and Meta (NASDAQ: META), which have moved to [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the intersection of high finance and political power has reached a new frontier. The Trump family, led by Donald Trump Jr., has successfully pivoted from the political arena into the bedrock of the global "Information Finance" (InfoFi) movement. With strategic advisory roles at the industry’s two largest platforms, Kalshi and [...]

Via PredictStreet · February 6, 2026

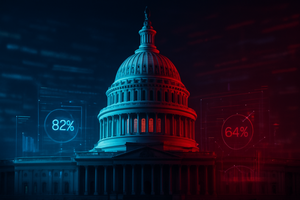

As the 2026 midterm election cycle enters its most volatile phase, prediction markets have coalesced around a startlingly clear vision of the future: a deeply divided Washington. According to the latest data from Polymarket and Kalshi, the probability of Democrats retaking the House of Representatives has surged to a dominant 82%, while Republicans maintain a [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the prediction market industry is no longer just a niche playground for political junkies; it is the front line of a massive constitutional and regulatory war. At the center of this storm is Kalshi, the federally regulated exchange that has spent the last year oscillating between landmark legal victories and [...]

Via PredictStreet · February 6, 2026

The world of prediction markets is currently reeling from what critics are calling the most brazen example of "political insider trading" in the history of decentralized finance. Just weeks after U.S. special forces conducted "Operation Absolute Resolve" to apprehend Venezuelan President Nicolás Maduro, a single trader on the platform Polymarket has become the face of [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the prediction market landscape has officially transitioned from a niche corner of the internet into a high-stakes battleground for global financial supremacy. Dubbed "The Great Prediction War of 2026," the industry is currently witnessing an unprecedented clash between the decentralized heavyweight Polymarket and the federally regulated Kalshi. At the center [...]

Via PredictStreet · February 6, 2026

The year 2025 will be remembered in financial history as the moment prediction markets evolved from a niche curiosity into a foundational pillar of the global economy. What was once dismissed as "gambling for nerds" has transformed into a high-stakes "truth machine," providing real-time data that traditional polling and expert analysis have struggled to match. [...]

Via PredictStreet · February 6, 2026

The primary market under the microscope is Kalshi’s "Pro Football Champion" contract, which specifically tracks the winner of Super Bowl LX. Unlike a traditional bet where a bookmaker sets a line and takes a margin (the "vig"), these event contracts allow users to trade shares of an outcome in a peer-to-peer fashion. At the current [...]

Via PredictStreet · February 5, 2026

As of February 5, 2026, the global information landscape has been fundamentally reshaped not by a new cable news network or a government intelligence agency, but by the relentless, cold-blooded efficiency of prediction markets. What were once dismissed as niche "gambling" platforms for political junkies have evolved into what institutional analysts now call "Geopolitical Truth [...]

Via PredictStreet · February 5, 2026

The legal boundary between a "hedge" and a "bet" has reached a breaking point. As of February 5, 2026, the prediction market industry is locked in what experts are calling a "jurisdictional civil war," pitting the federally regulated exchange Kalshi against a phalanx of state regulators. At the heart of the storm is a question [...]

Via PredictStreet · February 5, 2026

In the world of finance, information has always been the most valuable currency. But as of early 2026, how that information is gathered, verified, and broadcast has undergone a fundamental transformation. The 2024 U.S. Election was the "proof-of-concept" for prediction markets; today, they have become the "Oracle Layer" for the global economy. Major media conglomerates, [...]

Via PredictStreet · February 5, 2026

The capture of Venezuelan leader Nicolás Maduro by U.S. special operations forces on January 3, 2026, was a geopolitical earthquake that few saw coming. But for one anonymous trader on the decentralized prediction platform Polymarket, the event was more than a headline—it was a $400,000 windfall. Hours before President Donald Trump took to Truth Social, [...]

Via PredictStreet · February 5, 2026

While the dust of the 2024 election cycle has barely settled, the financial world is already placing its bets on the next battle for the White House. As of February 2026, prediction markets—the once-niche platforms that successfully forecasted the 2024 outcome with surgical precision—are signaling a clear trajectory for the 2028 U.S. Presidential Election. Vice [...]

Via PredictStreet · February 5, 2026

As the clock ticks toward the February Consumer Price Index (CPI) release, a new kind of "game day" ritual is taking over the morning routines of young investors. Forget the NFL playoffs or the NBA finals—for the 24 million active users on Robinhood (NASDAQ: HOOD), the most exciting play of the season is the "Macro [...]

Via PredictStreet · February 5, 2026

As the Federal Reserve's March 2026 meeting approaches, a striking divergence has emerged between traditional financial instruments and the burgeoning world of "Information Finance." On Kalshi, the federally regulated prediction market, traders are increasingly convinced that the central bank will pivot toward easing. Currently, 64% of participants on the platform are betting on a 25-basis-point [...]

Via PredictStreet · February 5, 2026

The global financial landscape has shifted into a new era of "Information Finance," or InfoFi, where the most valuable commodity is not gold or oil, but the "truth." As of February 5, 2026, the battle for dominance in this sector has narrowed down to two titans: Polymarket, the decentralized, crypto-native pioneer, and Kalshi, the regulated, [...]

Via PredictStreet · February 5, 2026

The prediction market industry has officially shed its label as a niche corner of the internet for political junkies and sports bettors. As of early February 2026, the sector is celebrating a watershed moment: total trading volume surpassed a staggering $45 billion in 2025, a nearly five-fold increase from the previous year. This momentum shows [...]

Via PredictStreet · February 5, 2026

The concept of "Information Finance," or InfoFi, has transitioned from a niche crypto-economic theory into a foundational pillar of global finance and media. As of February 2, 2026, prediction markets are no longer viewed as mere platforms for speculation; they have been repositioned as sophisticated data-transmission mechanisms that assign a market price to the accuracy [...]

Via PredictStreet · February 2, 2026

As the calendar turns to February 2026, the United States is bracing for a political showdown that promises to be as much a financial event as a democratic one. The 2026 U.S. Midterm Elections are already generating unprecedented activity in the prediction market space, with traders pouring billions of dollars into contracts determining the future [...]

Via PredictStreet · February 2, 2026

As of early February 2026, the global financial landscape has undergone a silent but profound architectural shift. Prediction markets, once dismissed as "gambling for nerds," have matured into the essential "Oracle layer" of the financial system. Today, institutional liquidity and algorithmic trading bots no longer wait for official press releases or the slow-moving updates of [...]

Via PredictStreet · February 2, 2026

The prediction market landscape was forever altered on January 2, 2026, by what traders are now calling the "January 2nd Shockwave." While the industry has long flirted with mainstream relevance, this single day of unprecedented institutional-sized trades—triggered by a geopolitical "black swan" and a massive injection of Wall Street capital—has cemented prediction markets as the [...]

Via PredictStreet · February 2, 2026

Polymarket, the prediction market platform that dominated the 2024 global news cycle, has officially entered its next act. In a bold strategic shift finalized in January 2026, the platform has transitioned from a fee-free information hub into a revenue-generating financial infrastructure. This move is headlined by the introduction of up to 3% "taker fees" on [...]

Via PredictStreet · February 2, 2026

As of February 2, 2026, the meteoric rise of prediction markets has hit a significant roadblock not in Washington D.C., but in the state houses of Nevada and Connecticut. While 2025 was defined by Kalshi’s historic legal victory against the Commodity Futures Trading Commission (CFTC), 2026 has opened with a multi-front "guerrilla war" as state [...]

Via PredictStreet · February 2, 2026

As of early February 2026, the financial world has officially crossed the Rubicon. Prediction markets, once relegated to the fringes of internet forums and academic theory, have fully integrated into the DNA of the global financial system. The tipping point arrived not with a single event, but through a series of massive institutional migrations that [...]

Via PredictStreet · February 2, 2026

In the early morning hours of January 3, 2026, the world woke to the stunning news that U.S. Army Delta Force commandos had successfully captured Nicolás Maduro in a daring raid codenamed Operation Absolute Resolve. While the geopolitical shockwaves were immediate, a different kind of explosion was occurring in the world of "InfoFi" or information [...]

Via PredictStreet · February 2, 2026

As of early February 2026, the prediction market landscape has transformed from a niche hobby for "superforecasters" into a multi-billion dollar pillar of the global financial system. At the heart of this explosion is a titanic struggle for dominance between the two undisputed heavyweights: Polymarket and Kalshi. The stakes are nothing less than the title [...]

Via PredictStreet · February 2, 2026

As of February 1, 2026, the global financial landscape has been fundamentally rewired by a concept once relegated to the fringes of crypto-economic theory: Information Finance, or "InfoFi." What began as a tool for political junkies to hedge election risks has evolved into the world’s most potent data transmission mechanism. Prediction markets have transitioned from [...]

Via PredictStreet · February 1, 2026

As the world wakes up on February 1, 2026, the traditional tools of diplomacy and statecraft are increasingly being viewed through a new, high-resolution lens: the prediction market. In a year already defined by unprecedented volatility, three major geopolitical flashpoints have emerged as the primary drivers of global speculation. Traders are currently navigating a landscape [...]

Via PredictStreet · February 1, 2026

The landscape of global finance reached a definitive turning point in late 2025, as prediction markets shed their reputation as "crypto-native niches" to become a cornerstone of the institutional financial stack. This transformation was signaled most loudly by the Intercontinental Exchange (NYSE: ICE), the parent company of the New York Stock Exchange, which finalized a [...]

Via PredictStreet · February 1, 2026

The traditional news ticker is undergoing a radical transformation. As of February 1, 2026, the familiar crawl of stock prices and weather updates has been joined—and in some cases replaced—by a far more dynamic metric: real-time "wisdom of the crowd" probabilities. From the halls of the U.S. Congress to the red carpets of Hollywood, prediction [...]

Via PredictStreet · February 1, 2026

The dawn of 2026 has marked a definitive shift in the global financial ecosystem: prediction markets are no longer the exclusive playground of crypto-native speculators and data scientists. What was once a niche corner of the internet, often viewed with regulatory skepticism, has been institutionalized. Today, the "Wall Street Takeover" of prediction markets—now increasingly referred [...]

Via PredictStreet · February 1, 2026

The landscape of American financial forecasting shifted fundamentally on January 29, 2026. In a move that market participants are calling a "regulatory ceasefire," Commodity Futures Trading Commission (CFTC) Chairman Michael Selig formally withdrew the proposed ban on political and sports event contracts—a relic of the Rostin Behnam era that had throttled the industry for nearly [...]

Via PredictStreet · February 1, 2026

The predawn hours of January 3, 2026, will be remembered for one of the most audacious military operations in modern history: "Operation Absolute Resolve." As U.S. special operations forces descended on Caracas to extract Venezuelan President Nicolás Maduro, the geopolitical landscape shifted in an instant. But while the world watched the tactical execution of the [...]

Via PredictStreet · February 1, 2026

As the Seattle Seahawks and New England Patriots prepare to take the field for Super Bowl LX at Levi’s Stadium in Santa Clara, California, a quiet financial revolution is unfolding in the stands and across the Golden State. Despite California’s long-standing and contentious ban on traditional sports betting, residents are currently pouring millions of dollars [...]

Via PredictStreet · February 1, 2026

The prediction market landscape has officially entered its most volatile and high-stakes era yet. Following a staggering 2025 that saw over $40 billion in total trading volume, the industry is now locked in what analysts are calling the "Great Prediction War." This isn't just a race for market share; it is a fundamental clash between [...]

Via PredictStreet · February 1, 2026

As of January 30, 2026, the way we consume news on X (formerly Twitter) has undergone a fundamental shift. No longer just a scroll of opinions and viral clips, the platform has transformed into what analysts are calling an "Information Finance" (InfoFi) engine. The cornerstone of this transformation is the seamless integration of live prediction [...]

Via PredictStreet · January 30, 2026

As the prediction market industry enters its most ambitious year to date, a single contract on Manifold Markets has emerged as the definitive "North Star" for traders, regulators, and venture capitalists alike. The contract—"Which Prediction Market will have the highest total USD-equivalent trading volume in 2026?"—is currently trading with Polymarket as the 47% favorite, followed [...]

Via PredictStreet · January 30, 2026

As the calendar turns to January 30, 2026, the global financial eye has shifted from the traditional exchanges of Wall Street to the high-stakes digital arenas of prediction markets. The primary catalyst is the 2026 U.S. Midterm Elections, which have rapidly ascended to become the most significant volume driver in the history of the forecasting [...]

Via PredictStreet · January 30, 2026

As we enter the first quarter of 2026, a fundamental shift is occurring in the architecture of global finance. For decades, institutional trading desks relied on the "terminal" model—terminal data from legacy providers, consensus surveys, and government reports—to price risk. Today, that hierarchy has been inverted. Algorithmic trading bots are no longer just participants in [...]

Via PredictStreet · January 30, 2026

As of January 30, 2026, the financial landscape has undergone a tectonic shift. What were once dismissed as "speculative casinos" for crypto enthusiasts and political junkies have matured into the world’s most efficient "truth machines." Prediction markets, led by platforms like Polymarket and Kalshi, are no longer just places to bet on who will win [...]

Via PredictStreet · January 30, 2026

As of January 30, 2026, the global financial landscape is witnessing the official dawn of "InfoFi"—Information Finance. Prediction markets, once relegated to the fringes of the internet and academic white papers, have shattered the glass ceiling of mainstream adoption. This shift is being driven by a historic pivot from Silicon Valley’s titans, most notably Alphabet [...]

Via PredictStreet · January 30, 2026

As of January 30, 2026, the meteoric rise of prediction markets faces its most existential threat yet: a "jurisdictional civil war" between federal regulators and state gaming authorities. While platforms like Kalshi have successfully argued their case before the Commodity Futures Trading Commission (CFTC) and federal courts, a new wave of state-level cease-and-desist orders is [...]

Via PredictStreet · January 30, 2026

On January 20, 2026, the landscape of American finance shifted when Robinhood Markets, Inc. (NASDAQ:HOOD) announced it had acquired a 90% majority stake in MIAXdx, a CFTC-regulated derivatives exchange. This move signals more than just a corporate expansion; it marks the moment prediction markets—once a niche interest for crypto enthusiasts and political junkies—officially became a [...]

Via PredictStreet · January 30, 2026